Robert Kiyosaki’s rich dad, his best friend’s father, felt that the relationship between the two was critical. However, these classes don’t teach why one document is important to the other, or how they affect each other.

#RICH DAD POOR DAD CASHFLOW CHART HOW TO#

Many people who take accounting classes learn how to read an income statement and balance sheet separately. If you do not understand these concepts, the only way you’ll succeed in investing is by sheer luck, not skill.

#RICH DAD POOR DAD CASHFLOW CHART DOWNLOAD#

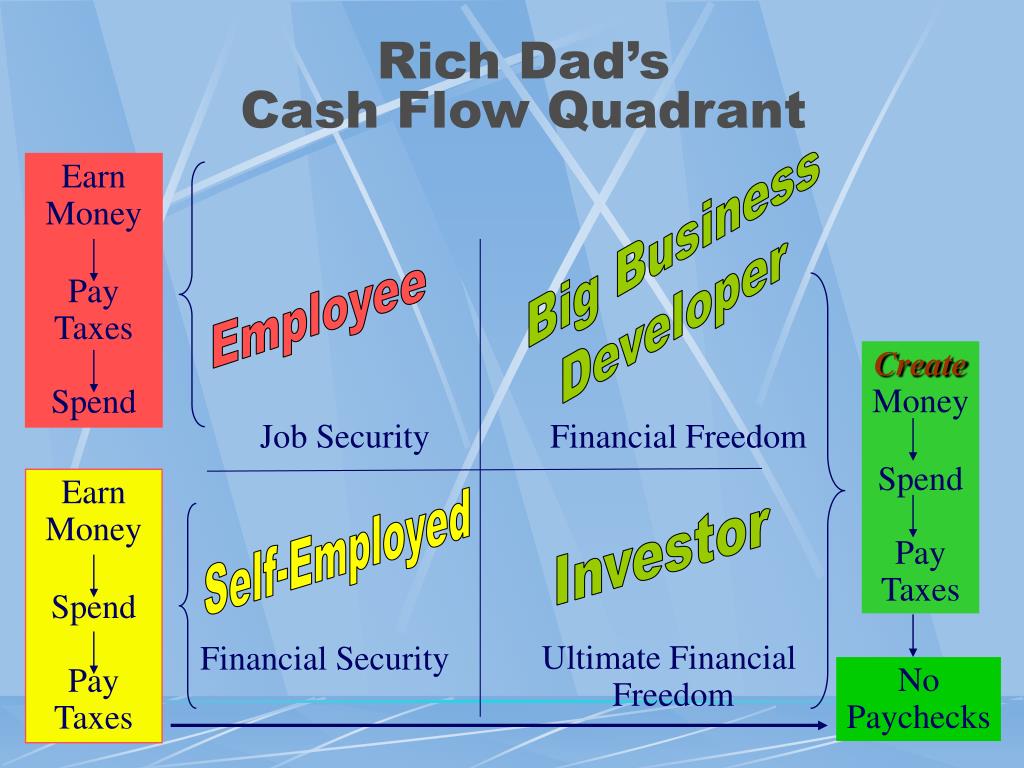

In the Rich Dad personal financial statement, which you can download here, you can see the relationship between these concepts. What is a personal financial statement, you ask? It tracks your income, expenses, assets, liabilities, and cash flow - each of these is crucial to not only understanding your personal financial standing, but they are also a barrier to entry when it comes to any investment opportunities. Give the same $100,000 to a person with a low financial IQ and a person with a high financial IQ, and you’ll see a vast difference in how that money is spent and grown.Ĭentral to the difference between those with low and high financial IQs is a simple but profound literacy: the ability to understand a financial statement. What makes you rich is your financial IQ. The reality is that money doesn’t make you rich. Financial literacy begins by understanding your personal financial statement They think that if they can just make a little more each month, all their problems will be fixed.

For most people, being rich means making a lot of money. This is perhaps the most important question you can ask and answer. The first step to understanding your personal financial statement, is comprehending the relationship between an income statement, and a balance sheet The rich have mastered the craft of reading their personal financial statements Understanding your personal financial statement doesn’t have to be difficult

0 kommentar(er)

0 kommentar(er)